This tool facilitates the sharing of medical data records with family members. This can help households to manage their healthcare as a group, benefiting individuals and the whole. Not only does sharing these records help to manage healthcare for geographically distributed families, but it provides security and easy of access when traveling or when managing health emergencies.

The First Opinion™ portal not only allows the patient to share with medical providers, but also facilitates managing family healthcare. This allows parents to centralize and control medical information for their dependents: young children and aging parents. This is particularly important with elderly family members, because as they age, they incur more medical issues. In 2019 more than half of adults 65 and older (54%) in the US reported taking four or more prescription drugs. How many of us know all of the prescription drugs taken by our aging parents? In case of a medical emergency, will the hospital be able to access this information in a timely manner to know what drugs to avoid due to potential harmful interactions? Currently there are no tools to help manage multiple medications remotely.

Often it is impossible to have all of the family within easy geographic access and the ability to access their medical records needs to be arranged before an emergency arises. This is also very helpful for accessing medical records when traveling. Currently, many records reside with the medical providers making accessing from abroad challenging at best.

Each individual is incentivized by revenue sharing to upload their information, but there are also incentives for the entire family resulting in constructive pressure to maintain compliance. Just as gyms employ personal trainers, families can motivate and assist other family members to stay current with their healthcare records.

Monetization of medical data by a typical family

We can estimate monetization of medical data from a typical family by presenting prototypes for several individuals. Consider a nuclear family of eight, three parents, two children, and three living grandparents. The children include a teen and two preteens, parents are 35-50, and grandparents are 65-85. In our example, one of the children has autism, one of the parents has mild medical problems, one of the grandparents has cancer and another has a neurological condition (e.g. Alzheimer’s or Parkinson’s).

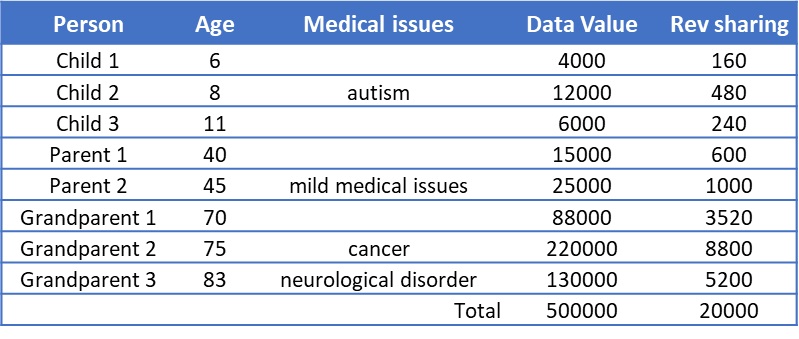

The table below lists the members of the hypothetical nuclear family along with the USD value of their medical data, and associated revenue sharing of 4% per year. The total family data package amounts to $500K and provides $20K in passive annual income.

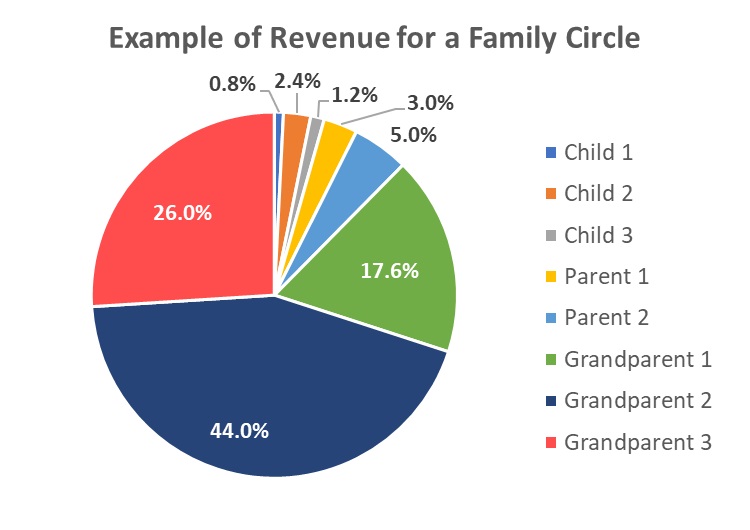

The pie chart above shows that the largest share of revenue sharing comes from cancer, which is both a severe disease and one that can be to treated with precision or personalized therapy. Neurological disorders currently lack drugs of comparable efficiency to those for cancers, although the latter are limited by lack of targeting or personalization of therapy. Therefore, a grandparent suffering from these neurological problems has less monetizable data compared with most cancer patients. However, this situation is not permanent, in fact, our model stimulates investment in innovation for drug discovery and facilitates these drugs reaching the intended patients.

Examples of utilization: homebuying and education funds

With Sanus a family is able to produce their own financial instrument, similar to how YouTube enables creation of new content. The content we enable is medical data, its sharing and monetization. In this section we briefly consider two examples of leveraging these funds when buying a house.

In the future, with Digital Collateral (DiCo) fully implemented, it will be possible to leverage the value of the data as an asset, $500K in our example. Before DiCo is realized the most actionable way to leverage the funds associated with medical data is to include $20K of associated annual revenue when applying for a loan and to direct these dividends towards monthly mortgage payments. Allowing dividends to accrue can help a family to save for a downpayment for a new house. In our simple example we assume a stable Data Package Value of $500K. Over 10 years, this would yield $200K of cumulative returns, which increases to $240K due to reinvestment. That means, for example, that parents can leverage the value of their healthcare to come up with nearly a quarter million downpayment, which doesn’t impact the data (principal) that cannot be sold for the living patients. The same funds can be used to fund a child’s education, with an even longer potential time horizon.

In addition, the tax structure affecting these distributions is favorable. Only realized gains are taxed, allowing accumulation of investment (for home buying or college education in our example) without a tax burden. In addition, our model will be able to provide “qualified” dividends which are taxed at the 20% rate not an individuals’ tax rate, which can be as high as 37%.

An example of cash investment

Consider a family wanting to invest money in addition to data. Consider parents investing $150,000 in savings for a teen’s education some seven years before college. The total dividends amount to $42,750 amounting to a total yield of 31.5%.

The investments in dividend-yielding instruments provide greater security, but with lower returns. Sanus has plans to create both DiCo (improved cryptocurrency) and equity instruments (for distribution of dividends), which focus on capital appreciation and yield respectively. We can estimate the capital appreciation potential that is supported by such substantial dividends in a field with the sustainability and scalability of the Medical Data Ocean to be at least twice as great, implying a long-term PE of 50. That means we would expect capital appreciation of $85,000 during the seven-year period, without affecting the principal. Thus, parents are able to provide for a child’s education and then get back to saving for other major items, or retirement.