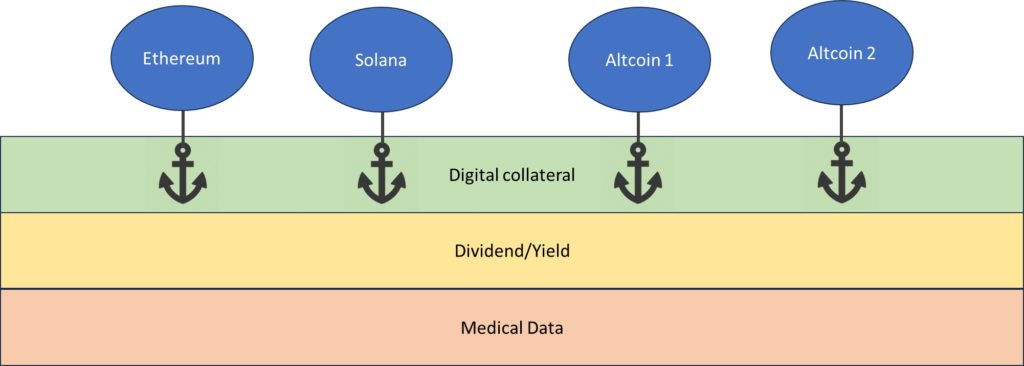

Digital Collateral (DiCo) for healthcare records can be leveraged like most other assets, with the exception that they cannot be sold while the patient is alive. A deceased patient can however bequeath their health records as part of their estate to their heirs who can continue to rent it or sell it because there will now be no new additional data to add and, any privacy issues are now moot. A living patient cannot give away rights to their healthcare information, but they can share and rent access to it. Of course, security and privacy of the patient’s information is a responsibility we take very seriously, with multiple layers of structured engineering controls. The typical Sanus financial arrangement is for the patient to receive annual dividends equal to 4% of the value of their shared medical data. For example, we estimate the value of data to be between $200K and 600K for a typical oncology patient, meaning they would be entitled to $8-24K in annual revenue sharing. This valuation per patient is justified because the value for more limited data collected in cancer clinical trials as currently carried out by the pharmaceutical industry is $1-10 million. We are shifting the ownership of the data to the patients where it belongs and working with them to collectively leverage the data, selling access to the industry to greatly improve efficiency of drug development as well as to help biotech to address burning problems like clinical enrollment and effective, targeted marketing.

DiCo based on medical data, or more precisely the Medical Data Ocean (DiCo-MDO) can provide significant revenue. The MDO effectively defragments human disease, allowing different medical data to be combined for various financial purposes. In the broadest sense it creates a single commodity of healthcare data that can be controlled as collateral. In 2022 the global spending on healthcare, oil and natural gas were approximately $10T, $2.1T, and $0.98T, respectively. DiCo-MDO can underpin a number of these transactions in the medical field as well as with major physical commodities. If we assume modest fees (0.1%) for DiCo used for settling a modest fraction (1%) of these national and international transactions the annual fees amount to over $130 million.